🚨ERC Recovery Now!

Fund your business with ERTC, the Employee Retention Tax Credit! Financial recovery options for small businesses to large.

Apply for ERC Now, Get Funds *ASAP!

* may take several months to receive.

Pre-Qualify & Apply for ERC now!

* We will not spam, rent, or sell your information.

🚨

ERC Recovery Now!

Fund your business with ERTC, the Employee Retention Tax Credit! Financial recovery options for small businesses to large.

Pre-Qualify & Apply for ERC now!

* We will not spam, rent, or sell your information.

Apply for ERC Now, Get Funds *ASAP!

* may take several months to receive

Get Pre-Qualified & Apply for ERC funds NOW!

Get Up To $26K Per Employee!

Beat the ERC Deadline!

ERC Recovery Now is brought to you by My Franchise CPAs, from Boca Raton, Florida. We will help you get the employee retention credits you are eligible for!

ERC Recovery Now is brought to you by My Franchise CPAs, from Boca Raton, Florida. We will help you get the employee retention credits you are eligible for!

What is the Employee Retention Tax Credit?

Simply put, ERTC is a FAT check in your hand.

Businesses owners can claim ERC on qualified wages paid to employees, and receive a check as high as up to $26,000 for every employee retained during the COVID pandemic.

Your eligibility as an employer is based on gross receipts of less than 80% in 2021 (versus less than 50%) in 2020 compared to the same quarter in 2019.

This means if your gross receipts decline more than 20% in 2021, or by more than 50% in 2020 then you are eligible to take the credit.

PLEASE NOTE:

– Taking this credit can impact your annual tax return.

– ERC is available to business owners only.

– Employees must be W-2 employees other than the owners to qualify for the employee retention program. Single owner businesses with subcontractors do not qualify.

How Does The ERC Application Process Work?

Step 1

PRE-QUALIFY

Step 2

ANALYZE

Step 3

APPLY

We guide you through the ERC Application Process, from beginning to end, including proper documentation.

ERC is not a loan!

You DO NOT need to pay it back!

The employee retention program was introduced to offer financial relief to businesses impacted by COVID-related restrictions. Your business may qualify for $26k per retained employee in ERC funds!

We charge a flat fee, no big percentages like other ERC companies!

If you get a million dollar check, we won’t be looking for 10% of it. You retained your employees, that is your money!

Beat The ERC Deadline!

Get Your Money before It Runs Out!

What is ERTC,

Employee Retention Tax Credit?

ERC Recovery Now Testimonial

- Debbie

What is ERTC,

Employee Retention Tax Credit?

ERC Recovery Now Testimonial

- Debbie

How to Qualify for ERC, the Employee Retention Credit:

ERC Requirements – Employers, including tax-exempt organizations, are eligible for the employee retention program if they operate a trade or business during calendar year 2020 or 2022 and experience either:

- The full or partial suspension of the operation of their trade or business during any calendar quarter because of governmental orders limiting commerce, travel or group meetings due to COVID-19, or

- A significant decline in gross receipts.

A significant decline in gross receipts begins:

- On the first day of the first calendar quarter of 2020

- For which an employer’s gross receipts are less than 50% of its gross receipts

- For the same calendar quarter in 2019.

The significant decline in gross receipts ends:

- On the first day of the first calendar quarter following the calendar quarter

- In Which gross receipts are more than of 80% of its gross receipts

- For the same calendar quarter in 2019.

The credit applies to qualified wages (including certain health plan expenses) paid during this period or any calendar quarter in which operations were suspended, to W2 employees.

(From IRS.gov)

Employee Retention Credit FAQ

ERC FAQs – These are the most frequently asked questions about the ERC we get from our clients.

What is the ERC?

Is this for real??

YES!

See more details at the IRS website, this is legit and the money WILL run out!

https://www.irs.gov/coronavirus/employee-retention-credit

ERC Recovery Now is brought to you by My Franchise CPAs. We are a full service CPA firm and can assist you with tax planning and more, we are here for YOU, the worker, and will never endorse anything that is not legit!

What do you charge?

When do you start?

We start as soon as you book a time! The process starts now so book a time and let’s get you a check!

When do I get my money?

The IRS is backlogged, which can cause delays in the timing of your funding. It could take several months to receive your funds.

Who will handle my application?

One of our founders, Jason Yeaman, or John Mollica, from My Franchise CPAs.

How do I qualify for the 2021 ERC credit?

Should I talk to my spouse or business partner?

Absolutely!

Please discuss this with your spouse or business partner before we talk.

We move quickly and want to get you paid before the funding runs out!

Can I qualify for the retroactive 2020 credit?

How Much ERC Could a Business Receive?

Can I take advantage of the ERC if I took both rounds of PPP?

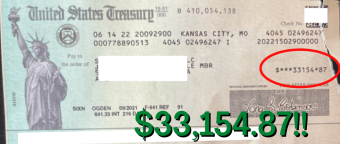

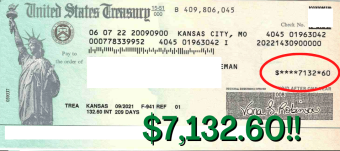

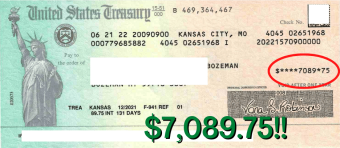

🎉 Our ERC Success Stories

ERC Refunds Approved by ERC Recovery Now...

ERC Refund Amount:

$60,000 for Debbie – See testimonial

ERC Refund Amount:

$50,000 – Salon in Boca Raton

ERC Refund Amount:

$50,000 – Scott B.

ERC Refund Amount:

$38,000 – Tim S.

🎉 ERC Checks Our Clients Received!

PRE-QUALIFY FOR ERC!

✓ Fund Your Business

✓ Pay Your Employees

✓ Hire New Employees

✓ Add New Products

✓ Buy New Equipment

✓ Upgrade Your Software

✓ Re-Stock Your Inventory

PRE-QUALIFY FOR ERC!

✓ Fund Your Business

✓ Pay Your Employees

✓ Hire New Employees

✓ Add New Products

✓ Buy New Equipment

✓ Upgrade Your Software

✓ Re-Stock Your Inventory